Biden's Latest $7.4 Billion Student Loan Forgiveness: Impact and Insights

Biden's new $7.4 billion student loan forgiveness plan, its impact on 277,000 borrowers, and the broader political implications

-

Introduction

- Overview of the recent announcement

- Significance of the debt relief measure

-

Overview of the New Forgiveness Initiative

- Total amount forgiven and number of beneficiaries

- Context within the Biden administration's broader educational policies

-

Details of the $7.4 Billion Forgiveness Plan

- Specific groups targeted by the new initiative

- Comparison with previous loan forgiveness efforts

-

Mechanics of the SAVE Plan

- Explanation of the SAVE program's eligibility and benefits

- How SAVE differs from earlier programs

-

Impact and Reception

- Reception by various political groups and the general public

- Expected impact on borrowers and the economy

-

Legal Challenges and Political Implications

- Overview of legal challenges facing the new repayment plan

- Potential political fallout and its implications for upcoming elections

-

FAQs

- Common questions about the new student loan forgiveness initiative

-

Conclusion

- Summary of key points

- Encouragement to stay informed on further developments

Introduction

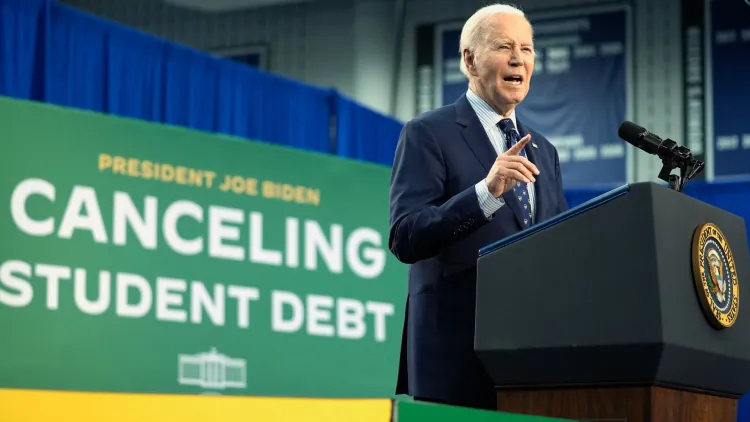

The Biden administration has recently announced an additional $7.4 billion in student loan forgiveness, impacting 277,000 borrowers. This initiative is part of a series of measures aimed at reducing the financial burden of education and providing relief to students in debt.

Overview of the New Forgiveness Initiative

This latest round of debt forgiveness will use existing programs to alleviate the debts of public sector workers and low-income borrowers, among others. It's a continuation of Biden's commitment to education reform and debt relief as articulated since his campaign.

Details of the $7.4 Billion Forgiveness Plan

The $7.4 billion will primarily benefit those enrolled in specific forgiveness programs, including the newly established SAVE plan, designed to accelerate the path to debt relief for qualifying borrowers.

Mechanics of the SAVE Plan

The SAVE plan represents a significant overhaul of previous loan forgiveness programs. It offers reduced monthly payments and quicker debt forgiveness, particularly benefiting those who have borrowed less than $12,000 by providing relief after 10 years of payments.

Impact and Reception

The initiative has been met with mixed reactions. While many borrowers celebrate the relief, some Republican leaders criticize it as costly and unfair to taxpayers who did not attend college or have already repaid their loans.

Legal Challenges and Political Implications

Republican-led states have launched legal challenges against the SAVE plan, arguing it oversteps executive authority. The outcome of these cases could significantly impact the plan's implementation and have broader political consequences as the November elections approach.

FAQs

- Who qualifies for the new forgiveness measures?

- How does the SAVE plan work?

- What has been the political reaction to the initiative?

Conclusion

The Biden administration's new student loan forgiveness initiative marks a significant step towards educational reform and debt relief. As the legal and political landscapes evolve, it is crucial for stakeholders and borrowers to stay informed about these changes.

What's Your Reaction?